Payroll tax calculator massachusetts

3 Months Free Trial. Pre-tax Deductions 401k IRA etc Check Date MMDDYYYY Next.

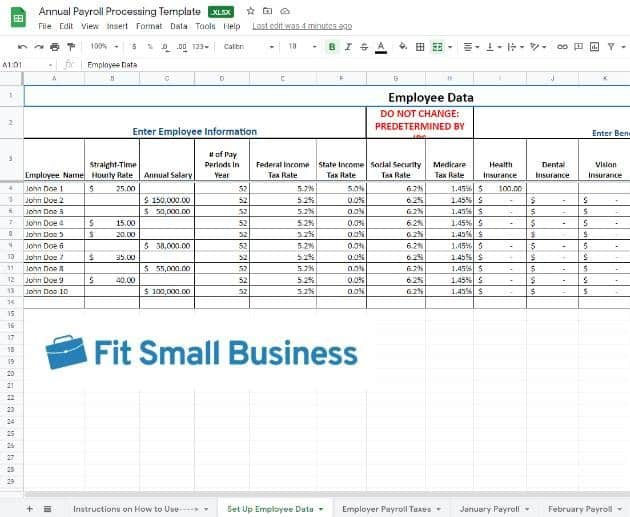

How To Do Payroll In Excel In 7 Steps Free Template

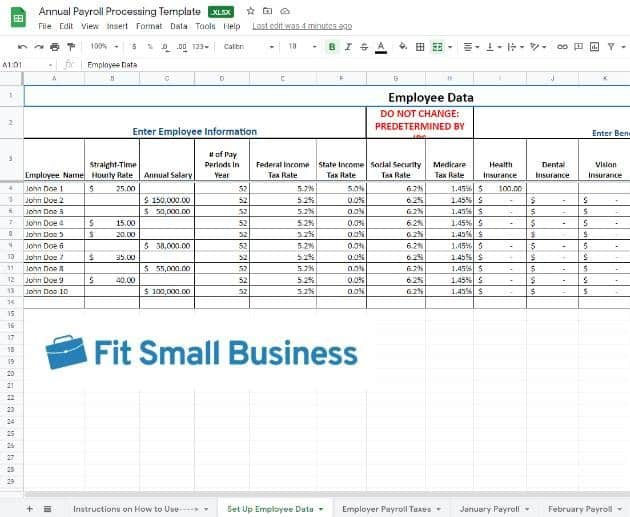

This number is the gross pay per pay period.

. Social Security. The calculator above can help you with steps three and four but its also a good idea to either double-check the calculator by using the payroll tax rates below or save time and effort by using a reliable payroll service. This is a sample calculation based on tax rates for common pay ranges and allowances.

202223 Tax Refund Calculator. Refer to Tax Foundation for more details. The PaycheckCity salary calculator will do the calculating for you.

3 Months Free Trial. Filing Quarterly Estimated Taxes. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor you can use the free Montana Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across Montana.

For instance it is the form of income required on mortgage applications is used to determine tax brackets and is used when comparing salaries. If you would like to get a more accurate property tax estimation choose the county your property is. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

This administrative penalty waiver allows a first-time noncompliant taxpayer to request abatement of certain penalties for a single tax periodone tax year for individual and business income taxes and one quarter for payroll taxes. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. Figure out your filing status.

Pre-Tax Deductions Pre-tax Deduction Rate Annual Max Prior YTD CP. Understand your nanny tax and payroll obligations with our nanny tax calculator. Offer period March 1 25 2018 at participating offices only.

Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Massachusetts paycheck calculator. Whirlpool Refrigerator Led Lights Flashing. For high earners Affordable Care Act that makes the employee-paid portion of the Medicare FICA tax subject to a 09.

You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year. The only complain i have that I was told this led light would last for a long time but its died twice and the Whirlpool refrigerator is only two years old IcetechCo W10515057 3021141 LED Light compatible for Whirlpool Refrigerators WPW10515057 AP6022533 PS11755866 1 YEAR WARRANTY This is shown on the service. May not be combined with other offers.

For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035. Subtract any deductions and payroll taxes from the gross pay to get net pay. According to TIGTA for tax year 2010 the average individual failure-to-file abatement qualifying under FTA was.

See Massachusetts tax rates. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Massachusetts local counties cities and special taxation districts. This 90k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Massachusetts State Tax tables for 2022The 90k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Massachusetts is used.

Total Non-Tax Deductions. Work out your adjusted gross. Your average tax rate is 165 and your marginal tax rate is 297.

Lets go over federal payroll taxes first shall we. US Tax Calculator and alter the settings to match your tax return in 2022. Start filing your tax return now.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. In the US the concept of personal income or salary usually references the before-tax amount called gross pay. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

Your individual results may vary and your results should not be viewed as a substitute for formal tax advice. Exemptions to the Pennsylvania sales tax will vary by state. The Pennsylvania sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the PA state sales tax.

Starting as Low as 6Month. To qualify tax return must be paid for and filed during this period. Additional Medicare Tax on amounts over the statutory threshold.

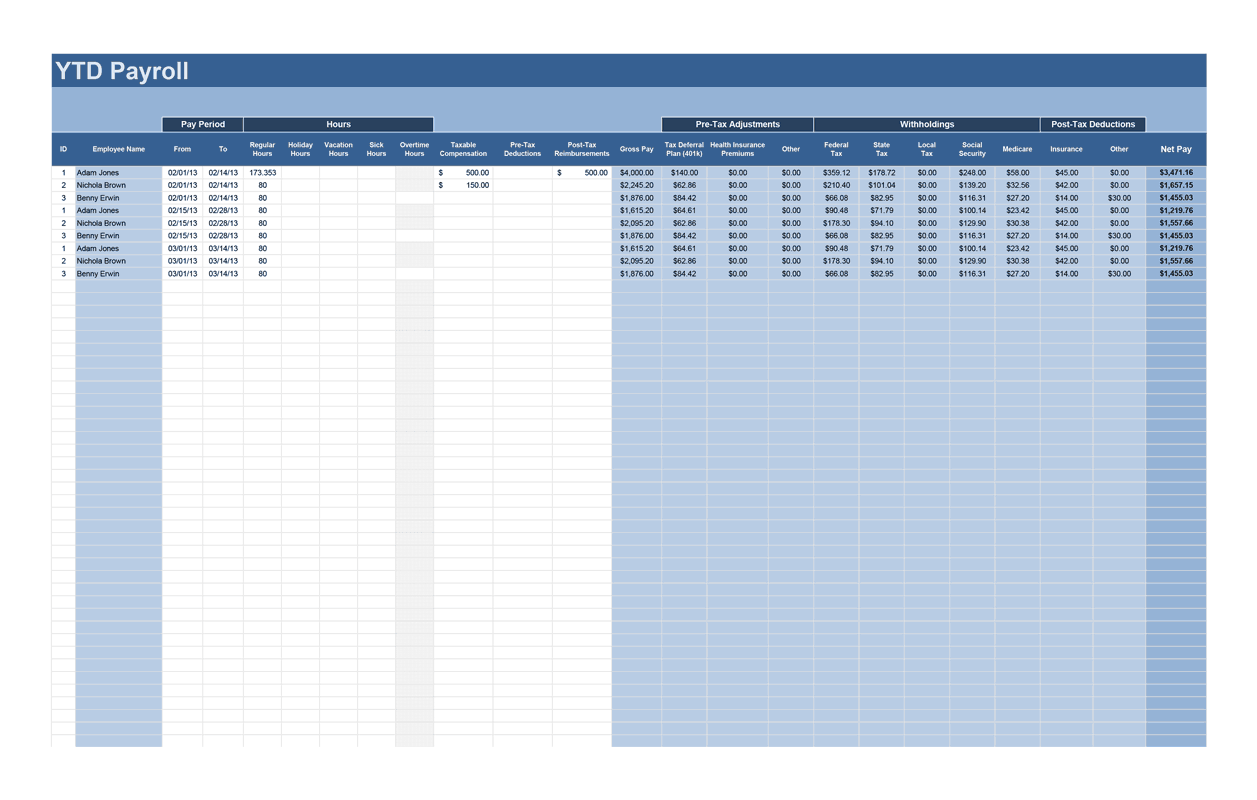

Weve organized federal income taxes into a 6-step overview. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. 125000 for married taxpayers who file separately.

How Marginal Tax Brackets Work. Our handy payroll calculator will help you figure out the federal payroll tax withholding for both your employees and your business. Then you can use the IRS withholding calculator to understand what tax rate to apply for each employee.

200000 for single and all other taxpayers. For specific advice and guidance please call us at 1. Small Business Low-Priced Payroll Service.

Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator. Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a tax that varies by income level reaching rates as high as 133 in California. 250000 for married taxpayers who file jointly.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Tax year Filing status Taxable income Rate. Elective Deferrals401k etc Payroll Taxes Taxes.

Exemptions to the Massachusetts sales tax will vary by state. Computes federal and state tax withholding for paychecks Flexible hourly monthly or annual pay rates bonus or other earning items. Dont want to calculate this by hand.

The steps our calculator uses to figure out each employees paycheck are pretty simple but. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Colorado has no state-level payroll tax.

Related Income Tax Calculator Budget Calculator. Payroll check calculator is updated for payroll year 2022 and new W4. Small Business Low-Priced Payroll Service.

Use our Massachusetts sales tax calculator. Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer whether paying a nanny a senior. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets.

Federal Payroll Tax Rates.

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Massachusetts Paycheck Calculator Smartasset

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Calculate Net Pay Step By Step Example

Job Progress Report Template 3 Templates Example Templates Example Progress Report Template Report Template Progress Report

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Payroll Software Solution For Massachusetts Small Business

Payroll Tax Calculator For Employers Gusto

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Payroll Taxes Methods Examples More

Massachusetts Paycheck Calculator Smartasset

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Payroll Taxes Methods Examples More

Payroll Software Solution For Massachusetts Small Business

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Payroll Software Solution For Massachusetts Small Business

Pin Page