Dmv tax calculator

The browser you are using is not supported for the DC DMV Online Services. Ad Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

Dmv Fees By State Usa Manual Car Registration Calculator

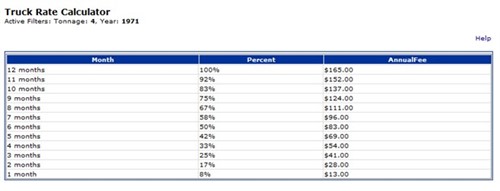

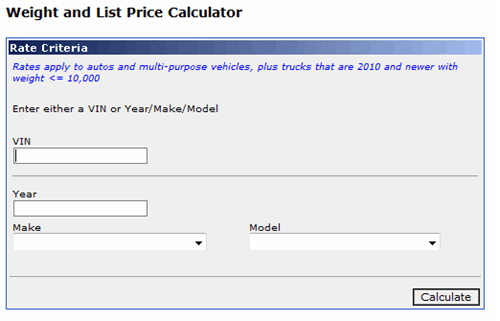

The first calculation is the DMV Valuation of the vehicle which is 35 of MSRP.

. North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. Vehicle Value Tax Calculator. To apply for a lesser tax due at the time of registration when disagreeing with NADA value.

Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Ad Avalara excise fuel tax solutions take the headache out of rate calculation compliance. If this is the original registration first time you register your vehicle you must pay the.

Vehicles are also subject to. How to estimate registration fees and taxes. Lease Excess Wear Tear Excess Mileage.

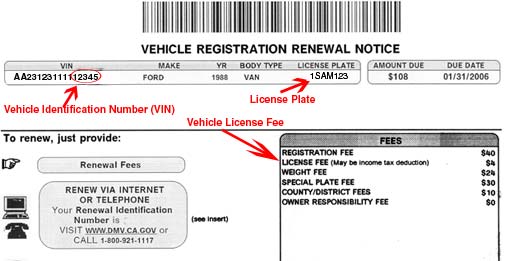

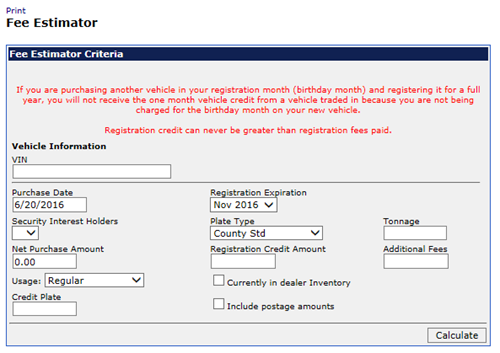

Motor Vehicle Trailer ATV and. The SalesTaxHandbook Sales Tax Calculator is a free tool that will let you look up sales tax rates and calculate the sales tax owed on a taxable purchase for anywhere in the United States. The fee calculator is for estimating your vehicles documentation and registration fees.

Use this calculator to compute your 2022 personal property tax bill for a qualified vehicle. For example Idaho charges a 6 tax which means you multiply the cost of the car 37851 and multiply it by 006. The DC DMV Vehicle Registration and Title Fee Estimator is provided to assist District residents in calculating the excise tax registration inspection tag title lien and residential parking fees.

In this case its 37851 x 006 227106. Penalty Fee for Uninsured Motorist 10000 for the first 30 days then 500 per day every day after 10000. Department of Motor Vehicles.

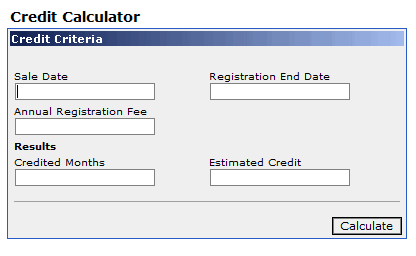

Registration Fees and Taxes. Please input the value of the vehicle and the number of months that you. Driver and Vehicle Records.

The State attempts to maintain the highest accuracy of this fee calculator on its web site. The supported browsers are Google Chrome Mozilla Firefox Microsoft Edge and. Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price.

Information about titling and registering a motor vehicle trailer boatvessel or all-terrain vehicle license office locations information about registering. Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local.

The DMV Valuation is then depreciated 5 after the first year and 10 per year thereafter until it reaches. That means Idaho charges a sales.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate My Fees California Dmv

Fee Calculator Mesa County Colorado

Vehicle Registration Licensing Fee Calculators California Dmv

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Vehicle Registration Licensing Fee Calculators California Dmv

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Dmv Fees By State Usa Manual Car Registration Calculator

Car Tax Calculator Calculate Your Car Taxes Car Insurance Cheap Car Insurance Car Insurance Tips

Vehicle Registration Licensing Fee Calculators California Dmv

![]()

Fee Calculator Totally Notary And Vehicle Registration Service

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Vehicle Registration Licensing Fee Calculators California Dmv

Dmv Fees By State Usa Manual Car Registration Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags